Saturday, January 31, 2009

So Much For "Solar Baseload"

One of the most advertised of the various companies promoting CSP is Ausra. This company was founded by Australians and financed largely by Silicon Valley venture capitalists. Ausra was notable for its excessive braggadocio, claiming that within a few years its technology would be cheaper than all other alternatives. In recent weeks, however, Ausra has essentially admitted that these claims were merely so much hot air. Ausra CEO Robert Fishman announced that Ausra was scaling back its plans to build large plants, instead focusing on equipment sales. According to the Mercury News, "Fishman said Ausra will build small plants for companies that need industrial steam or electricity." So far from building huge CSP plants with storage that could offer a form of baseload power, Ausra is now planning on providing process heat to factories and auxiliary capacity to existing steam plants--a far cry from its ambitious plans a few years ago. Indeed, Ausra is laying off employees whose expertise was in large power plant construction in light of their new strategy.

Ausra still plans to complete its 177MW plant in Carrizo, California, but henceforth it plans to concentrate on decidedly "non-baseload" applications. Whether this business plan will work remains to be seen (efforts to market similar technologies in the 1980s fizzled), but this is a sign that their technology did not live up to expectations. Particularly interesting is the fact that the new applications that Ausra is marketing its collectors for do not involve storage--suggesting that their ambitious plans to store steam geologically were far from the "trump card" they had claimed. Clearly, Ausra is now paying dearly for its hubris.

Although Ausra has been mum on the issue, I have a suspicion that their solar concentrators have probably failed to perform up to expectations. DOE tested similar solar concentrators in the early 1980s and concluded that the cost advantages of the fresnel reflectors weren't worth the tradeoff in reduced performance. If the concentrators had performed well at Ausra's test facilities I suspect that it would be widely advertised in Ausra's marketing, so its reticence (and its difficulty attracting utility-scale orders) suggest some problems in this arena.

While Ausra is far from the only player in the CSP field and as such it ought not be conflated with the entire industry, well-apprised figures say that it is likely that many other firms are in similar straights. "I think it's going to be a brutal, brutal year for solar, and a lot of companies will go out of business," said Andrew Beebe, the CEO of Suntech Energy Solutions, which develops solar-power facilities for corporations and utilities. "A lot of mistakes were made. Now is the time of reckoning, and it's going to be ugly." Far from being poised to save the world, the solar industry is apparently fully occupied trying to save itself.

Friday, January 30, 2009

Will 50% of Nuclear Loan Gurantees Default?

But what are the assumptions behind the 50% figure?

To find out it is merely necessary to refer to the CBO website. Reporting on the Energy Policy Act of 2003, the CBO found that:

CBO considers the risk of default on such a loan guarantee to be very high--well above 50 percent. The key factor accounting for this risk is that we expect that the plant would be uneconomic to operate because of its high construction costs, relative to other electricity generation sources. In addition, this project would have significant technical risk because it would be the first of a new generation of nuclear plants, as well as project delay and interruption risk due to licensing and regulatory proceedings.

In its 2003 Annual Energy Outlook, the Energy Information Administration (EIA) projects that production from new nuclear power plants would not be cost-competitive with other power sources until after 2025. EIA also reports that current construction costs for a typical electricity plant range from $536 per kilowatt of capacity for natural-gas-powered combined-cycle technology to $1,367 per kilowatt of capacity for coal-steam technology. Although construction costs could diminish significantly as a new generation of nuclear plants are built, a new nuclear power plant starting construction in 2011 would have a construction cost of about $2,300 per kilowatt of capacity. By 2011, that cost would result in capital costs that are 40 percent to 250 percent above the cost of capital for electricity plants using gas and coal. Because the cost of power from the first of the next generation of new nuclear power plants would likely be significantly above prevailing market rates, we would expect that the plant operators would default on the borrowing that financed its capital costs.

Assuming the nuclear plant is completed, we expect it would financially default soon after beginning operations, however, we expect that the plant would continue to operate and sell power at competitive market rates. Thus, over the plant's expected operating lifetime, its creditors (which could be the federal government) could expect to recover a significant portion of the plant's construction loan. The ability to recover a significant portion of the value of the initial construction loan would offset the high subsidy cost of a federal loan guarantee. Under the Federal Credit Reform Act, funds must be appropriated in advance to cover the subsidy cost of such loan guarantees, measured on a present-value basis. CBO estimates that the net present value of amounts recovered by the government on its loan guarantee from continued plant operations following a default and the project's technical and regulatory risk would result in a subsidy cost of 30 percent or about $375 million over the 2011-2013 period. Based on information from DOE, we expect other loan guarantees would not be issued for nuclear power plants until after 2013.

Basically, the CBO determined that nuclear plants would default because they would be uneconomical compared to conventional coal and natural gas generators. The former, it appears, are not going to be in the picture due to government regulation. The latter's costs will depend considerably on future natural gas cost trends, but by the time new nuclear plants enter operation in the 2018 timeframe chances are that natural gas prices will have returned to high levels due to resurgent worldwide demand. Furthermore, electricity prices are definitely going to go up in the next decade. The EIA is predicting that retail electricity costs will be about 12 cents kw-hr one decade from now. Finally, many of the new nuclear plants are being planned by regulated utilities that can use rate-recovery to finance construction, and so long as they convince regulators that they have incurred costs prudently they are allowed to adjust electricity rates to cover costs. The scenario outlined by the CBO--nuclear being uncompetitive with coal-fired electricty--is exceedingly unlikely to cause a default at a regulated utility, and given projected increases in retail electricity rates, deregulated utilities as well.

Thursday, January 29, 2009

The Aqueous Homogeneous Reactor Lives!

Soviet researchers never attempted to develop AHRs for power production, but they did develop these reactors for a practical application: radioisotope production for medical use, in addition to certain research applications. To this end they developed a series of AHRs culminating in the ARGUS: a miniature AHR producing a mere 20-50 kw thermal.

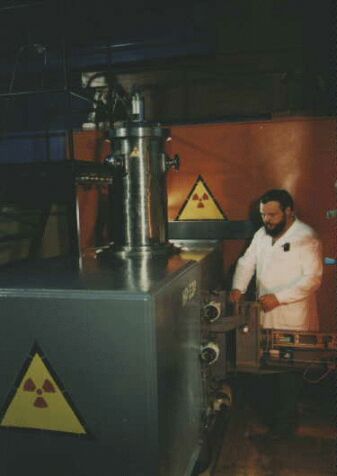

The ARGUS reactor: it's a wee little beastie

The AHR has two big advantageous for medical isotope production: firstly, its fluid fuel form makes extraction of isotopes from the fuel much simpler than from solid-fuel reactors. Secondly, AHRs have excellent safety characteristics. They have strongly negative temperature and void coefficients, making them essentially self-controlling. However, the corrosion issues associated with uranyl sulphate fuel have resulted in the abandonment of AHR research in most of the world. This is not the case, however, in Russia. In September of last year the Physico-Energetic Institute in Obninsk (normally known as the Institute for Physics and Power Engineering) announced plans to build a new nuclear medicine facility on the basis of a modernized AHR:

На промышленной площадке ГНЦ РФ «Физико-энергетический институт» в г. Обнинске Московской области предлагается создать комплекс по производству радиоизотопов на основе новой технологии с применением растворного реактора малой мощности. Как отметили в ФЭИ, проект растворного реактора для наработки и выделения радиоизотопов непосредственно из топливного раствора является одной из самых существенных разработок, осуществленных с участием радиохимиков. По словам директора отделения изотопов и радиофармпрепаратов ФЭИ Николая Нерозина, проект позволяет использовать реактор малой мощности 50(82) кВт для получения следующих изотопов медицинского назначения: Mo-99, Sr-89, Xe-133, а также смеси изотопов йода.From the published articles I gather that this reactor will be an evolved version of the ARGUS, designed to operate on 20% U-235 rather than the HEU utilized in the original ARGUS. Given the recent economic downturn, these plans for a new AHR in Obninsk may be scrapped, but clearly the researchers at the Kurchatov Institute and IPPE believe that the AHR is the solution to the worldwide problem of producing radioistopes for nuclear medicine without resorting to reactors using HEU. Personally, I wish them all the success in the world.

In the industrial sector of the GNTs RF "Physico-Energetic Institute" in the city of Obninsk, Moscow Oblast, the construction of a complex for the production of radioisotopes on the basis of new technology utilizing a solution reactor of low power is planned. As described by FEI, the project for a solution reactor for the production and extraction of radioisotopes extracted directly from the fuel solution is one of the most significant developments, being carried out with the assistance of radiochemists. In the words of the director of production of isotopes and radiopharmaceuticals Nikolai Nerozin, the project will utilize a reactor of low power 50(82) kWt for the production of the following isotopes with medical uses: Mo-99, Sr-89, Xe-133, and also a variety of isotopes of iodine.

Wednesday, January 21, 2009

Just Say No to Portfolio Standards

Omaha-based energy company Tenaska Inc. plans to move forward with building a $3.5 billion clean-coal plant in Illinois after the Illinois General Assembly passed the Clean Coal Portfolio Standard Act.This is the stupidest thing I've ever heard. But then again, it makes as much sense as portfolio standards for renewables, or nuclear power, or anything else. The problem with portfolio standards is that they are corporaratist giveaways to the manufacturers of various technologies, which mandate the use of certain options whether they make physical, economic, and environmental sense or not. Portfolio standards are bad policy and will not be an effective substitute for carbon pricing. The sooner our country's leaders realize this, the better.

The new legislation would require large utilities in the state to enter into long-term contracts to buy up to 5 percent of their electricity from clean-coal facilities, such as Tenaska's Taylorville Energy Center in Taylorville, Ill., said Bart Ford, vice president of business development at Tenaska.

Clean-coal facilities must capture at least 50 percent of their greenhouse gas emissions in order to qualify.

Monday, January 19, 2009

Russia Seeks Japanese Nuclear Plant

The government plans to send senior officials to Moscow for final-stagenegotiations on concluding a bilateral civil nuclear cooperation agreement with Russia, government sources said Saturday.

The move, which could happen later this month, is part of efforts to settle the matter before Russian Prime Minister Vladimir Putin visits Japan, taking into consideration that Putin is placing importance on energy. No date has been set for the trip.

The plan expected to pave the way exporting a modern nuclear power plant to Russia. The Japanese government's initial plan was to conclude the deal if Putin visited Japan by the end of 2008. But the visit was scratched by the global financial crisis, and the talks remain in limbo.

In past negotiations, Japan and Russia have clashed over involvement by the International Atomic Energy Agency. Japan is demanding the agency conduct a "strict examination" of Russia's nuclear facilities to confirm the plant will be used for peaceful purposes. Russia showed reluctance by insisting the country is already a nuclear power, the sources said.

Since Japan will field its own candidate this fall to take over the U.N. nuclear watchdog, the government is expected to continue to press Russia to accept the demand so it can gain support from other countries in the election.

The idea of Russia importing Japanese nuclear power plants is an old one--it was first floated in the 1970s when the USSR was experiencing great difficulty building VVER-1000 pressure vessels. My guess, however, is that Russia may be interested in acquiring more modern technology to bolster their nuclear export business. Currently, Rosatom can only sell its reactors to former Soviet satellites and developing countries. But if Rosatom licensed more modern technology, it could conceivably market its wares in the first world while undercutting Japanese and European vendors on price--potentially winning profitable new markets for Russia, while avoiding the need to develop a new LWR itself.

Note that Russia's primary next-generation reactor effort--the BN-series liquid-metal fast breeder--cannot be exported for proliferation reasons, in addition to the fact that it will probably prove economically uncompetitive with LWRs. So the royal road for Russia to compete in the global nuclear reactor market in the intermediate term is to import foreign technology. (Note that China and Britain are basically doing the same thing with their plans to start building AP1000s domestically). Especially worrisome (for Rosatom) is that cost trends suggest that its latest version of the VVER-1000 is probably going to be only slightly cheaper than reactors like the AP1000, so it really needs to come up with a strategy to compete in the global nuclear market after the 2020 time frame. But I'm not quite sure what's in it for the Japanese.

Thursday, January 08, 2009

A Federal RPS: A Very Bad Idea

Obama and Biden will create a federal Renewable Portfolio Standard (RPS) that will require 25 percent of American electricity be derived from renewable sources by 2025, which has the potential to create hundreds of thousands of new jobs.A federal RPS is simply bad policy, for a variety of reasons:

1) It's inequitable. Because different parts of the country vary enormously in their renewable energy potential, some parts of the country (such as my native Tennessee) would probably never be able to meet the 25% standard, even if cost were no object. I imagine that there will be some kind of trading scheme to address this imbalance, but it will both place enormous pressure on more endowed areas of the country to overinvest in renewable generation, and also increase the cost of compliance for have-nots. Therefore, to the extent that renewable portfolio standards are good policy (which I don't think they are) they should really only be mandated on a state-by-state basis.

2) It's economically inefficient. Unlike carbon pricing, a RPS does not encourage end-users to change their preferences in light of environmental externalities, but rather forces utilities to purchase power from sources that may not be appropriate. The need to meet targets will also create a massive distortions, allowing the renewable energy industry to increase their prices and making their product more expensive than it needs to be. This deprives other possible carbon-mitigation measures, from efficiency to nuclear power, of capital that would be more efficiently invested in them.

3) It's probably unattainable, given European experience with similar policies. The UK's decision to pursue new nuclear power plants resulted from a politically unpopular discovery that even in windy Britain, renewable energy just doesn't live up to the hype. Despite the DOE's report that wind could provide 20% of US electricity by 2030, this estimate is based on extremely optimistic assumptions that seem thoroughly debunked by European experience. Keep in mind that US electricity use will probably grow at least some by 2025, so growing from current US renewable capacity to 25% would involve a near-unimaginable number of new generators--given average capacity factors for solar and wind generators, probably 4x or more the size of the current US nuclear fleet in terms of nameplate capacity, in just over 15 years.

On the whole, a federal RPS is a boondoggle that will misallocate resources and distract attention from more efficient and effective means of combating global warming. I will grant, however, that it would probably live up to its promise to "create hundreds of thousands of jobs"--but only at the expense of being an enormous drag on the economy, in addition to huge federal subsidies. As the stimulus also promises:

They [Obama and Biden] will also extend the Production Tax Credit, a credit used successfully by American farmers and investors to increase renewable energy production and create new local jobs.If renewable energy is a sensible investment, carbon pricing will be all that is necessary to expand its utilization to an appropriate level. If renewable energy is such a good idea, why is it necessary for the government to force people to buy it? Carbon pricing, whether cap-and-trade or a carbon tax, is a much more appropriate policy for addressing climate change. A federal RPS is simply a very bad idea.

Tuesday, January 06, 2009

Are Gen III+ Nukes "Prudent?"

In his conclusion, he states that:

The goal should be a reliable and cost effective utility network. This is the goal – not a particular type of power plant or a particular set of plans to defend.The problem here is that utility executives do not have any kind of single-minded determination to pursue nuclear power at any cost. In fact, most of the utilities planning new nuclear builds are doing so not because they are stricken with an "irrational exuberance" they need to be disabused of, but because of the need to prepare for a carbon-constrained future. If the prospect of carbon pricing wasn't looming, no one would be pursuing new nuclear plants.

Utility management shouldn’t be too exciting. If an idea starts to look like it could have excessive business risks and costs, it is best to re-assess and find less risky ways to meet the goals. The last generation of utility managers nationwide reached this conclusion about nuclear power. This Paper has shown reasons why these executives were right, even though they had to cancel nuclear plans they themselves, plus a powerful nuclear lobby and a pro-nuclear government, had at one point advanced.

If current-day utility executives and utility regulators will now consider these facts, the nation can proceed to address the energy challenges we face, with far less rancor and risks, and lower costs overall, than if a futile attempt is made at great cost to revive a nuclear industry that has never kept its promises to provide a competitive and viable generation source.

To understand why building new nuclear plants is a prudent decision for a utility to make, we have to think ahead, to what conditions might possibly be like in the 2020s. In light of carbon pricing, old coal plants will either have to limit their operation or shut down entirely. Those that do operate will be expensive (as this is the entire purpose of carbon pricing). Even with license extensions older nuclear plants will be reaching the end of their operational lifetimes. This will open a very important qualitative gap in the generation mix of the utilities thinking about new nuclear builds.

Much like Amory Lovins, Severance makes the erroneous assumption that a kw-hr is a kw-hr, no matter what, and we should simply select the very cheapest generation option and be done with it. But this raises an important question--why do utilities invest in generators that don't have the lowest available lifetime cost? In other words, why did they invest in gas turbines and not coal plants?

The answer, of course, is that utilities have to provide power when and where it is wanted, and demand is not constant. Different technologies vary considerably in their ability to adjust to rapid changes in load. As circumstances have it, only two technologies in widespread use really lend themselves to peak power generation--hydroelectric dams and gas turbines. It is unlikely that many more of the former will ever be built in this country; the latter were the great winner in the energy field in recent decades. But gas has high operating costs, which discourages its use for off-peak generation. Baseload power is produced by coal and nuclear plants, which serve as the foundation of the generating capacity of many utilities. Basically, any policy to address climate change will tear the heart of these utilities' generating fleets, and the new nuclear units are a hedge to avoid this possibility.

Since a carbon-pricing scheme will force the utilities to close their amortized coal plants, they need to plan new baseload capacity to be available to keep providing reliable services. And right now, new nuclear plants are the only available option available for this role. Of course, this claim is disputed by renewable-energy enthusiasts, but the most currently hyped "baseload" renewable option--concentrated solar thermal--will not work in most of the areas considering new nuclear plants, due to want of direct sunlight. These areas generally lack geothermal and wind resources as well, although the latter don't constitute a real "baseload" source in any case. Fanciful proposals to build huge CSP plants in the southwest and transmit the power east of the Mississippi are not realistic alternatives to nuclear reactors for utilities in places like South Carolina. For all the barriers to building a new nuclear plant, they are minuscule compared to the technical and legal barriers facing such a scheme.

It is possible to use natural gas for baseload. Indeed, this is how most electricity in Russia is generated. But the example of Russia neatly illustrates why increased reliance on natural gas is ill-advised. Firstly, electricity in Russia is expensive and in short supply; and secondly, the Russian government is determined to maximize revenue from gas exports, and therefor drive up world prices. For these reasons, the Russians are planning to nearly double the size of their domestic nuclear fleet in the next ten years and are betting the long-term future of their electricity sector on nuclear power.

Of course, no one in their right mind would build generating capacity as expensive as Severance's 30 cent/kw-hr figure. This figure is in "nominal" dollars--essentially, a value from ten years in the future inflated from present dollars, and so would be lower in 2009 terms. But the reason that companies like Progress and FPL are ordering new plants is that they will not cost this much. Part of the reason for this is that Severance has used excessively pessimistic estimates for aspects of the nuclear fuel cycle for mining, milling, enrichment, waste disposal and decommissioning. Another reason the 30-cent figure is an overestimate is because Severance makes the assumption that the massive run-up in nuclear construction cost estimates between 2000 and 2008 will continue until the end of the next decade, nearly doubling construction costs. There is no good reason to believe this, given the recent collapse in commodities prices and the probable near-term global increase in the number of nuclear component vendors. Finally, Severance assumes a 14.5% average cost of capital, but regulated utilities in Florida and South Carolina are expecting to use rate recovery to finance plant construction, resulting in far lower capital costs. So the power generated by these plants will cost nowhere near 30 cents kw-hr. Just how much will depend on the degree of construction cost escalation and the cost of capital, but I expect a final figure in the 11-15 cents kw-hr range.

This is admittedly not cheap, although ten years from now this will probably be fairly competitive in the electrical generation field. I myself, and many readers of this blog, are confident that with a concerted effort we can develop nuclear plants in the next decade with vastly lower capital and operations costs than Gen III+ LWRs. Still, at the moment these utilities have no better options. These nuclear plants are not premised on massive future demand growth; they are are premised upon massive future generation loss. They cannot reasonably expect any technology--be it wind, "clean coal," or, sadly, Gen-IV nuclear--to be available in the next fifteen years to avoid the need for these new units. Right now, the utilities can either order new nuclear plants or risk being left without the ability to provide reliable service in the 2020s. They've chosen the former. And that's just prudent.

Saturday, January 03, 2009

Time Magazine on New Nukes

Nuclear power is on the verge of a remarkable comeback. It's been three decades since an American utility ordered a nuclear plant, but 35 new reactors are now in the planning stage. The byzantine regulatory process that helped paralyze the industry for a generation has been streamlined. There hasn't been a serious nuclear accident in the U.S. since the Three Mile Island meltdown in 1979. And no-nukes politics has become a distant memory. It was a sign of the times when John McCain ridiculed Barack Obama for opposing nuclear energy--and the allegation wasn't even true. "There's only a very small minority in Congress that still opposes nuclear power," says Alex Flint, the top lobbyist at the Nuclear Energy Institute (NEI). "That's quite a change."

...

So how should we produce our juice? The answer may sound a bit unsatisfying: more wind, less coal but mostly the same electricity sources we're using, until something better comes along. The key will be reducing demand through energy efficiency and conservation. Most efficiency improvements have been priced at 1¢ to 3¢ per kilowatt-hour, while new nuclear energy is on track to cost 15¢ to 20¢ per kilowatt-hour. And no nuclear plant has ever been completed on budget.

It appears that the author's conclusions were influenced by our old friend Amory Lovins:

Energy maven Amory Lovins has calculated that, overall, new nuclear wattage would cost more than twice as much as coal or gas and nearly three times as much as wind--and that calculation was made before nuclear-construction costs exploded.Indeed, he provides plenty of unreferenced RMI talking points [link mine]:

A Warren Buffett--owned company has scrapped plans for an Idaho nuclear plant; banks and bond-rating agencies are skeptical as well. In fact, renewables attracted $71 billion globally in private capital during 2007 while nukes got zero. The reactors under construction around the world are all government-financed. "I have to keep explaining: France and China are not capitalist countries!" says Congressman Ed Markey, an antinuclear Massachusetts Democrat. "Nobody wants to put their own money into this so-called renaissance--just ours."Of course, the truth behind this is rather more complex. Buffett dropped his plans to build a plant in Idaho--only to turn around and buy Constellation, which owns five reactors and is planning to build more, beginning with Calvert Cliffs 3 in Maryland. Investment in nukes is definitely non-zero, as is evidenced by companies such as Hyperion and NuScale, among others. This also makes it sound as if renewables are never financed with government funds, when it's clear from the renewble industry's own lobbying that they lead a hand-to-mouth existence on the basis of government subsidies. Take, for instance, this Time piece from a few months ago:

In a press conference last week the leaders of the solar, wind, geothermal and hydropower industries called on Obama and the incoming Congress to look ahead. First, energy leaders asked Obama to immediately adjust the alternative-energy production credit to provide green investors with a cash rebate, rather than a tax reduction. With the economy tanking, simple tax credits — which Congress renewed in October and without which the renewable-energy industry would not survive — aren't the lure they once were for companies looking to invest in new energy projects.This gives a much more realistic picture of the situation. Worldwide, the renewables industry benefits from mandates, feed-in-tarriffs, and similar distortions that render utterly meaningless any appeal to the "wisdom of the market" in comparing new nuclear capacity and renewables in terms of gloabl investment. As the leaders of the industry themselves make clear, private investors put money into their businesses because they are a spectacular opportunity for rent-seeking. But I digress.